When Michael Dubsky’s college savings program account for his family froze in April 2022, he was left angry and confused.

Dubsky set up an account with the Maryland Prepaid College Trust — an investment plan designed to allow adults or children to save for educational expenses — for his two children as part of a goal to ease their burden from student debt.

But when tuition bills for his two University of Maryland students arrived in August, Dubsky had no answers on why his account was frozen, despite inquiring with Maryland 529, the government agency that runs the statewide savings program.

“It’s stunningly frustrating when you can’t get straight answers out of a government agency,” Dubsky said. “This is not some benefit that they’re doing for us. This is something that we put money into, thinking we were doing the smart and responsible thing.”

Throughout 2022, families across Maryland grappled with an error in the state’s prepaid college fund that left hundreds of account holders unable to access the benefits of their savings accounts. Now, a new bill in the Maryland General Assembly would investigate Maryland 529’s actions leading up to the calculation mistake that has put massive strain on families’ ability to pay for education.

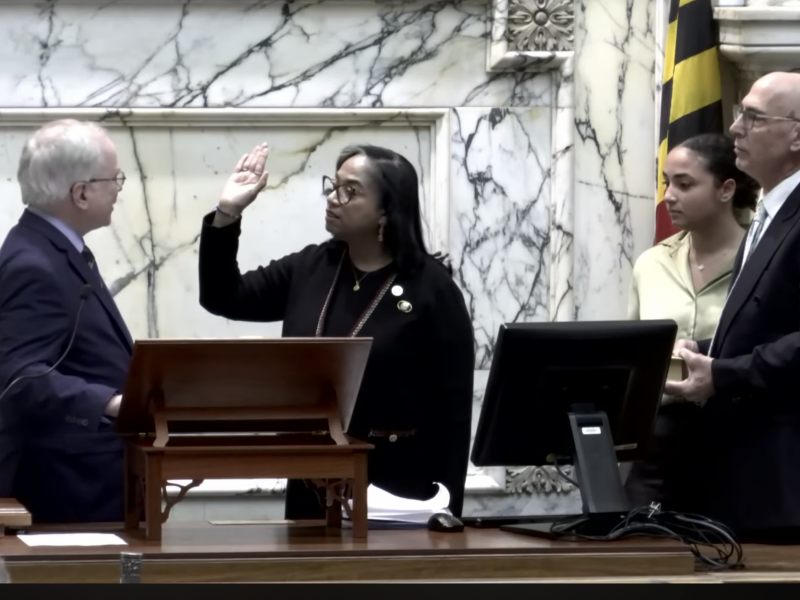

If the bill passes, it would establish a workgroup to examine the Maryland 529 program that would report findings on what led to the calculation issues and suggest improvements by June 2024. The bill’s state Senate committee hearing is scheduled for Feb. 22.

“Our goal is just to bring all the parties together so we can discuss possible resolutions for this,” said Jennifer Staley, a representative from the office of state Sen. Katherine Klausmeier, a sponsor of the Senate version of the bill.

[Some companies in Maryland could transition to a four-day workweek under new state bill]

Many parents currently cannot access all of the funds in their accounts or have had their current savings balances dramatically decrease since trying to address the issue with Maryland 529.

Troubles began with the program in November 2021 when Maryland 529 switched its management and implemented a new method of calculating interest in the fund. Soon after, the agency realized some of the new interest calculations were incorrect and suspended them until further notice.

Some parents like Dubsky were able to pay tuition after the error, but could not use other funds in the plan to pay for additional expenses, such as housing. He had to pay out of pocket to cover the difference in expenses caused by the Maryland 529 error. Many families are facing similar financial struggles, with some refinancing their homes or using their personal savings for college expenses.

As the agency works to resolve the calculation issues, users have had to request calculations of their prepaid trust earnings to know where they currently stand. Many families have received recalculations that they say are significantly lower than previous statements.

Kirk Litton currently has two policies in the Maryland prepaid plan that he purchased more than ten years ago. On his December 2021 statement from the trust, both accounts were valued at more than $70,000, nearly half of which came from interest earnings. However, the following year’s statement omits the reporting value altogether. Although Litton has yet to request a recalculation of his account, he expects that the new values will not include most of the interest that has accrued over the years.

“You can’t just say to somebody, ‘You signed a contract with the government, and we’re changing it, and it’s going to take $40,000 out of your pocket per policy,” Litton said.

[UMD Fearless Student Employees rallies for collective bargaining rights in Annapolis]

The issue impacted “dozens” of students at the state’s flagship institution, a university spokesperson wrote in an email.

“The error did cause anxiety and confusion,” University of Maryland President Darryll Pines told The Diamondback. “I’m grateful, however, to our financial services, which worked swiftly and thoughtfully with students who were affected to address any issue that was outside of our control.”

Because of the financial strain associated with the Maryland 529 error, many families believe the current timeline for the investigation outlined in the Maryland General Assembly’s proposed bill lacks the urgency necessary to help families currently struggling to pay for college expenses.

Parents have joined forces in a Facebook group that has more than 700 members where they share their stories, seek advice and plan organized action. The group is also drafting changes they’d like to see in this bill, such as setting a date for when the workgroup must hold their first meeting.

Litton is frustrated that the committee has a year and a half to report their findings.

“Families are hurting now. They’ve already been locked out of their earnings since almost a year,” he said.

CLARIFICATION: This story has been updated to clarify that Dubsky account was not completely frozen, but funds could not be rolled over to other plans.

CORRECTION: A previous version of this story misstated that the Maryland Prepaid College Trust is an investment plan. It is a contract plan. This story has been updated.