College Park leaders have proposed a tax increase for residential and commercial properties in the city’s 2025 fiscal year budget.

Currently, College Park has the lowest residential property tax rates in Prince George’s County for municipalities that have at least $1 billion in assessed value. If approved, the 2025 budget would mark College Park’s first property tax increase since the 2014 fiscal year budget — more than a decade ago.

The proposed budget includes an increase in residential property rates for non-apartment units from 30.18 to 34.18 cents per $100 of assessment. The proposal also recommends the city raise commercial, industrial and apartment real property tax rates by 20 percent to 40 cents per $100 of assessment for the 2025 fiscal year.

“I don’t necessarily have an issue with the taxes that the city enacts on its properties, as I think we provide really good value for that,” District 3 council member Stuart Adams said.

Under the proposed budget, general property taxes will make up about 55 percent of the city’s revenue. They comprised 46 percent of the city’s revenue in the 2019 fiscal year.

For the 2025 fiscal year, the city will split its property tax rates into two categories: residential properties — that do not include apartments — and commercial, residential and industrial apartment properties.

The distinction allows the city to maintain flexibility in setting tax rates, which often benefits residential homeowners, Kenny Young, the city manager, said in a statement to The Diamondback.

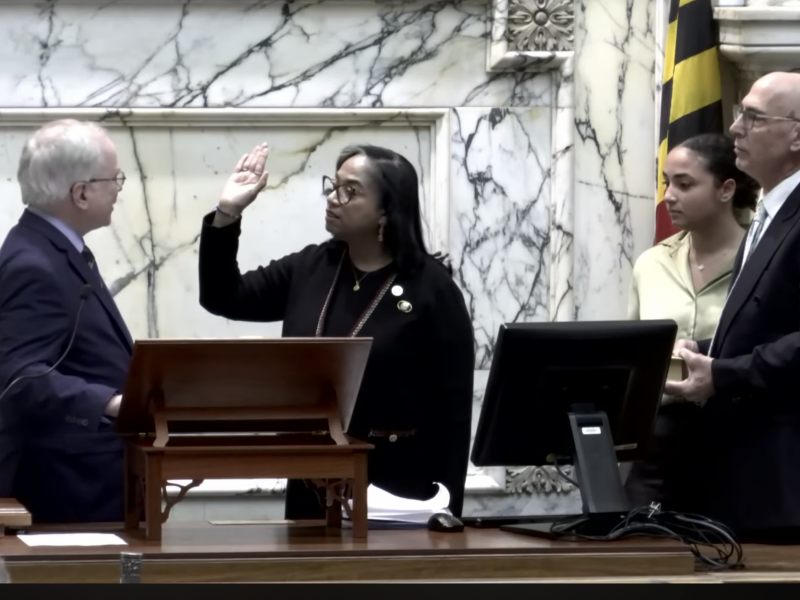

[College Park City Council discusses creating a youth advisory committee]

A significant portion of the additional tax revenue will help pay city staff members. The city has added 17 new full-time and five new part-time positions since the 2019 fiscal year and is proposing three new positions in the 2025 budget, according to Young.

These proposed new positions include a code enforcement manager, a youth and family services receptionist and a bilingual communications coordinator

“These new positions will help make our city more inclusive, safer and help residents access the services they need,” Young said in a video released by the city of College Park.

Adams emphasized that city staff positions are long-term commitments rather than one-time expenses.

Adams said that the city is being fiscally responsible with the new positions. Residents will be the primary beneficiaries of the staffing increase, he added.

“[Some] positions directly reflect what we’ve heard from residents on priorities that they want us to pursue,” Adams said.

In the 2019 fiscal year, 46 percent of the city’s budget was allocated for general government and administration and public services — which encompass most of the city staff salaries. About 52 percent of the proposed 2025 fiscal year budget will be devoted to those categories.

[Here’s a look at the College Park business scene in 2024]

But some city residents, including Henry Gue,are anxious about the proposed tax increase.

District 3 resident Henry Gue said the city’s explanation for the higher tax rates has been inconsistent. The city is operating adequately with the current staffing, Hue added, which makes the new positions unnecessary.

“The current staff has done an excellent job of meeting my needs,” Gue said. “In general, the city government doesn’t need to be that big to do the things that cities expect of their city governments.”

Adams also expressed discomfort with the rapid increase in property tax rates.

The proposed commercial, industrial and apartment property tax rate would be a 33 percent increase in a two-year period, Adams said.

“I’m actually uncomfortable with that amount of increase,” Adams said. “I hope as a council we can look to balance that out more.”

While Gue acknowledged that city leaders have “big aspirations” for College Park’s future, he hopes for more fiscal responsibility moving forward.

“All of those aspirations means spending more money and I just haven’t seen the careful consideration of what the budget implications are,” Gue said.

CORRECTION: A previous version of this story misstated that the proposed budget would increase residential property rates for non-apartment units to 0.3418 cents per $100 of assessment and commercial, industrial and apartment real property tax rates to 0.40 cents per $100 of assessment. Residential property rates for non-apartment units would increase from 30.18 cents to 34.18 cents per $100 and commercial, industrial and apartment real property tax rates would increase to 40 cents per $100. This story has been updated.