President Joe Biden announced Wednesday that federal student loan borrowers making less than $125,000 per year will have $10,000 of debt forgiven.

Pell Grant recipients will be eligible for $20,000 of debt forgiveness. Households earning less than $250,000 annually will also be eligible.

Borrowers who are current students are eligible for debt forgiveness. If the student is a dependent, they will be eligible based on parental income rather than their own. The loan must have originated before July 1 for a current student to qualify.

About 43 million federal student loan borrowers will be eligible for some level of forgiveness, including 20 million who could have their debt completely canceled.

People with direct federal loans, FFELP loans, Perkins loans, Parents PLUS loans and Grad Plus loans will be eligible for the forgiveness. Private loans will not be forgiven, according to Forbes.

[ UMD students commend Biden administration’s proposed Title IX changes]

Seven out of 10 college graduates with federal loans also receive a Pell Grant, a federal subsidy used to help pay for college. Pell recipients typically have an additional $4,500 more in debt compared to other college graduates, according to the Institute for College Access & Success.

Biden also extended the student loan repayment pause for the final time through Dec. 31. About 40 million borrowers have not been required to make student loan payments since March 2020 due to the pandemic. The pause has saved borrowers a collective $5 billion dollars each month.

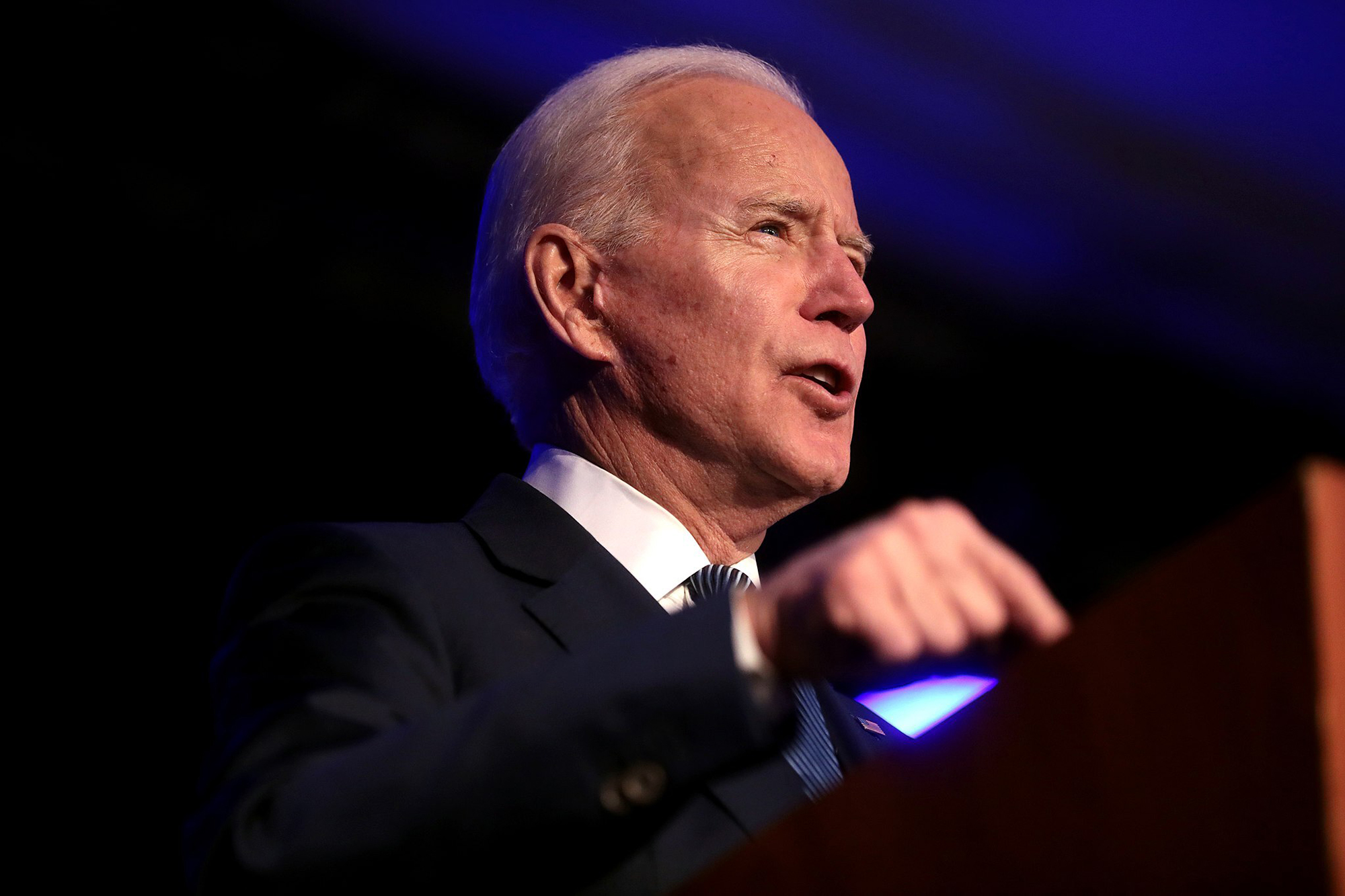

Biden made student loan cancellation a cornerstone of his 2020 presidential campaign. He consistently supported canceling $10,000 of student debt.

He received pressure from other senators, including Sen. Elizabeth Warren (D-Mass.) and Senate Majority leader Chuck Schumer (D-N.Y.), continue to support $50,000 of student loan forgiveness.

In his announcement, Biden touted the loan forgiveness plan as a way to “give working and middle-class families breathing room as they prepare to resume federal student loan payments in January 2023.”

This story has been updated.