Views expressed in opinion columns are the author’s own.

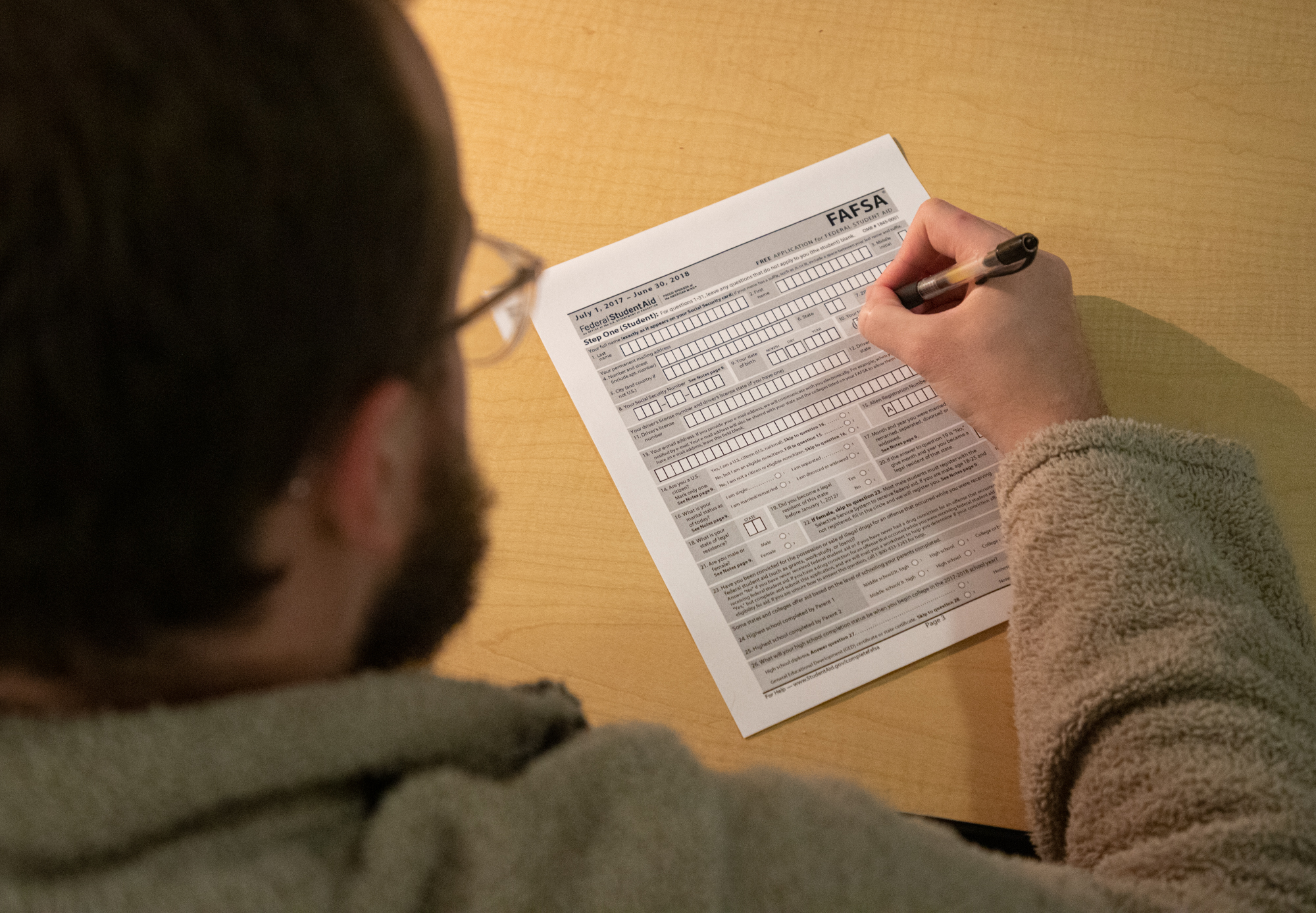

Student loans — predatory even without a pandemic — are increasing the financial pressure on students during this economically uncertain time. No one knows how long the current health and economic calamities will go on, which only leads to increased anxiety about how, if at all, individuals will make payments toward their student loans. The solution is simple: All student debt should be postponed or canceled not only for the immediate future, but for next year.

It’s not a secret that American university costs have risen disproportionately compared to the prices of other goods and income levels. The total U.S. student loan debt is currently $1.6 trillion dollars. Pandemic aside, student debt weighs down millions of Americans. But in a crisis like the one we face today, student debt shouldn’t be considered the first, second or even third essential cost for students and their families.

It wouldn’t be a radical decision to postpone all loan payments for the time being. Some financial burdens are already being eased; those with federal student loans won’t have to make payments for the next 60 days, and there won’t be any growth in interest or penalties if payments stop. Additionally, homeowners whose mortgages are through Fannie Mae or Freddie Mac now have the ability to reduce or suspend their mortgage payments for up to 12 months if they’ve suffered a loss of income due to the coronavirus. It’s not a cancellation of the loan; rather, it’s a way to shift payments to a lower amount or to a future date.

The suspension of government-backed loans is a step of good faith by elected officials, and it’s the right move to ensure people don’t have to choose between paying their mortgage or buying groceries. It’s a move private insurers should follow. Despite having a smaller share of the student loan market, private loans have variable interest rates that can be much higher than federal student loans.

Postponing all student debt would be the first step to providing immediate economic relief, and it could shift the national dialogue on how to deal with the crushing cost of college. Senate Democrats are calling for forgiveness for $10,000 of student loan debt for every borrower, the suspension of all interest capitalization on student loans and even indefinitely delaying federal loan payments.

The plan still needs congressional approval, and it would only apply to the ongoing crisis. But it still shows that when push comes to shove, politicians are able to treat student loans with the stringent legislation they deserve. Suspending federal loan payments for 60 days is a good start, but this outbreak likely won’t be over in two months.

By suspending loans for up to a year, the federal government would show its citizens that it cares more about the country’s well-being than collecting exorbitant amounts of debt payments. Private loan companies should take note as well, and if they choose to continue loan payments during this crisis, the government needs to step in to ensure their compliance.

Outbreaks are rare, but students suffering from crushing debt isn’t. The decisions on student loans will affect the student debt crisis long after the panic subsides and the virus fades. It’s crucial to do the right thing.

Maya Rosenberg is a sophomore journalism and public policy major. She can be reached at maya.b.rosenberg@gmail.com.