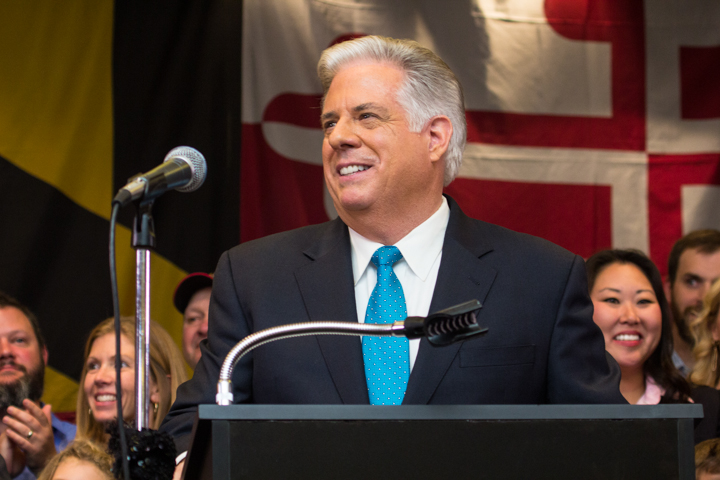

On Jan. 20, Gov. Larry Hogan introduced the second budget of his four-year term as Maryland’s chief executive. The budget, which will be debated and altered by the state legislature over the next three months, is the centerpiece of the 2016 legislative session in Annapolis.

Hogan’s budget is praiseworthy for many reasons: His commitments to tax relief for everyday Marylanders, job creation, education spending, environmental health and fiscal responsibility are all evident. The governor’s budget is a clear sign that he’s been listening to the people who elected him, as well as his Democratic counterparts in Annapolis.

Arguably the most important role of the state budget is to fund public schools, a responsibility the governor’s budget takes seriously. The budget funds K-12 education at the highest level in this state’s history, with a $6.3 billion allocation. Most importantly, every jurisdiction in the state will have more money to spend per student than it did last year. To give an example of just what the governor’s investment in education will mean to local jurisdictions, his allocation to Baltimore City amounts to more than $12,000 per pupil.

In terms of the environment, the budget demonstrates Hogan’s commitment to Chesapeake Bay by fully funding the Chesapeake and Atlantic Coastal Bays Trust Fund, which provides resources for bay restoration efforts. Interestingly enough, former Gov. Martin O’Malley never fully funded the trust fund during his two terms and consistently diverted money for other uses throughout his tenure.

Even with the budgetary commitments to the bay and K-12 education, Hogan finds room to provide modest tax and fee relief for most citizens, which is certainly a change of pace from the previous administration. Filing fees paid by small businesses would be reduced, retirees older than 65 would see a reduction in their state income tax, certain electricity fees would be reduced for Maryland families and, perhaps most importantly, low-income working families would benefit from an accelerated increase in the earned income tax credit.

This last measure was not originally the governor’s idea. The push for an increase in the earned income tax credit actually came during the previous session from an outspoken Hogan critic, Democratic Sen. Richard Madaleno, who serves as the Budget and Tax Committee vice chairman. It reflects well on the governor that his budget includes good ideas even from those who disagree with him.

Hogan also uses his budget to promote the creation of manufacturing jobs in the state. Middle-class job creation in the private sector has not only been a focus of the governor, but also is a target of outside analysts, who cite the lack of middle-wage private-sector jobs as a major weakness in the state’s economy. Hogan’s tax credit initiative for manufacturing closely mirrors that of another Democrat, Sen. Roger Manno, and focuses on creating manufacturing jobs in Western Maryland, Baltimore and the Eastern Shore.

Just as importantly, the governor’s budget makes a strong statement on fiscal responsibility, which is especially important considering the budget challenges the state will face over the next several years. The growth of mandated spending (which accounts for 83 percent of the budget) will give the governor little flexibility in changing spending behavior, and the O’Malley administration’s excessive bond authorizations along with increased Medicaid contributions necessitate fiscal responsibility and a focus on the long-term impacts of spending decisions. Hogan’s moves to reduce the state’s structural deficit by 90 percent, increase the Rainy Day Fund to more than $1 billion and limit bond authorizations are all steps toward our state living within its means.

In a nutshell, Hogan’s budget is the work of a leader who made the phrase “Change Maryland” his campaign slogan. It reaches new heights in helping everyday citizens and funding bipartisan priorities, all while maintaining fiscal responsibility. Marylanders can be proud of the work our governor is doing to make the state a better place.

Sam Wallace is a senior government and politics major. He can be reached at swallacedbk@gmail.com.