Views expressed in opinion columns are the author’s own.

Every year, as I watch my student loan debt climb higher and higher, I find myself concerned about my financial future. I regret not becoming more financially literate growing up. Perhaps if I had been proactive then, I wouldn’t feel so drastically unprepared now.

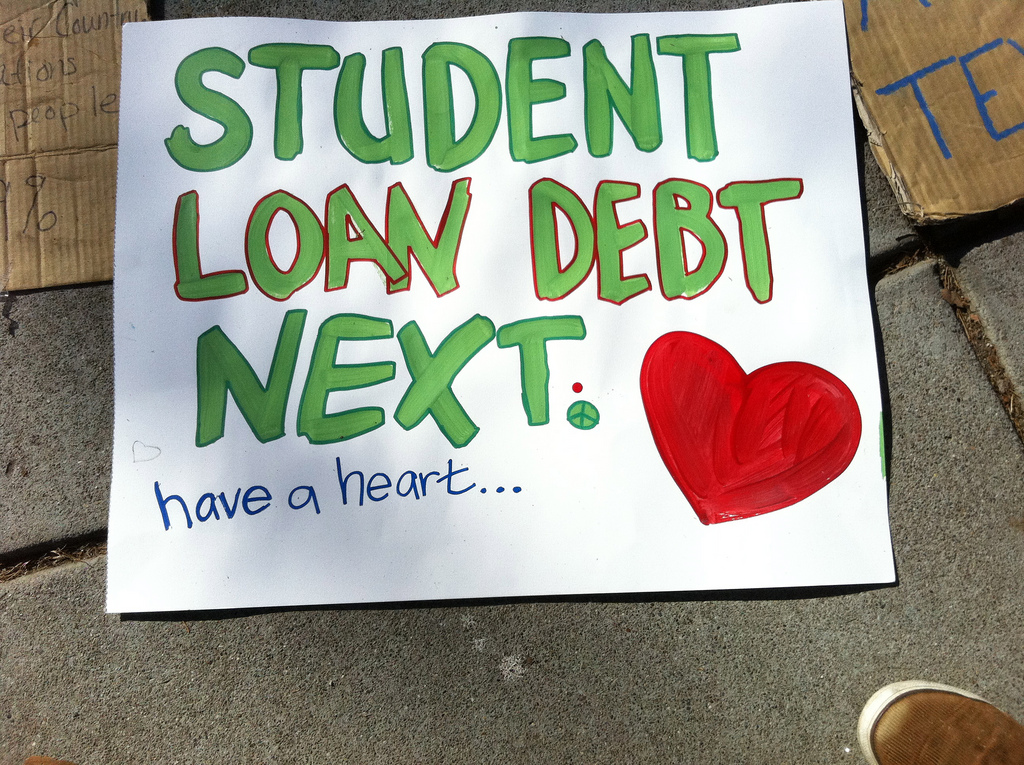

It is somewhat consoling that I’m not alone in this feeling. Student loan debt currently exceeds $1.1 trillion, and 39 percent of millennials worry about their financial future “at least once a week.” Although it’s comforting to see I am not the only one living in financial fear, it’s clear our educational institutions have failed to impart financial wisdom to their students.

Financial literacy is the ability to manage financial resources effectively in pursuit of a lifetime of financial wellbeing. This includes making everyday decisions about credit and debit management, understanding the risks and responsibilities of using a credit card and knowing how to avoid debt. These skills are essential to how we function in society and dominate our progression through life.

[Read more: Maybe college students are snowflakes]

First of all, many college students borrow money without grasping the difference between certain loans, grants and scholarships. Students also need to know how to create a realistic budget and repay debts in a timely manner. Unfortunately, very few people actually have these skills coming into college.

Financial literacy is even more relevant to life after college. As life expectancy increases and it becomes harder for seniors to survive on Social Security, retirement savings will be critical for millennials. If students are unprepared to make financial choices about their loans, it’s extremely unlikely that many of them are thinking about their retirements.

Some states, such as New Jersey, have passed legislation requiring high school students to complete coursework in financial, economic, business and entrepreneurial literacy.

Learning this practical information puts these students a step ahead of others. When implemented, these programs have proven effective: Financial literacy scores were considerably higher in schools with a financial education requirement in their curricula.

Though financial education is mandatory in some states, only 14 percent of teenagers have taken a class on financial literacy, despite 49 percent showing interest in learning more about money management, according to a Capital One study.

Maryland does not require a course in financial literacy. Many students like me feel unprepared to make their own financial decisions. Some organizations aim to help people gain confidence in their understanding of personal finance, such as the Maryland CASH Campaign, which offers free classes on financial literacy throughout the state of Maryland.

Participating in workshops like these is an excellent way to further one’s understanding of financial responsibility. However, programs like the Maryland CASH Academy should be supplemental to a broader conversation about financial literacy within high school curricula, so that students are ready to enter the realm of adulthood and fiscal independence.

Sydney Wess is a junior art history and broadcast journalism major. She can be reached at swess@terpmail.umd.edu.